From electronic health records to telemedicine, the digitization of healthcare in the countries of the European Union is progressing at different speeds and resembles a patchwork quilt. It is certainly true that there are a large number of promising European initiatives in the e-health sector. But a clear, pan-European vision is still lacking. In an impulse paper, we argue for an integrated e-health strategy. Particularly in times of crisis, a common approach offers advantages and strengthens the competitiveness relative to the powerful markets of China and the USA. This also extends to the development and distribution of European e-health solutions.

Since September 2020, health apps or “DiGAs” can be prescribed in Germany by a doctor. This was done 3,700 times in the last quarter. The ten providers approved to date have thus generated a combined turnover of around EUR 1.7 million. This corresponds to less than 0.02 percent of drug prescriptions in the same period. Even with optimistic growth assumptions: at this rate, it will take a long time to bring forth companies that can play a strong role in the digital health market. Good products should have better opportunities to be scaled. A single e-health market in Europe, serving as a large domestic market, would provide better opportunities for European companies to grow, attract foreign providers to a larger extent, and in this way promote quality competition, the results of which would be beneficial to the provision of health care throughout Europe.

Situation in comparison with China and the USA

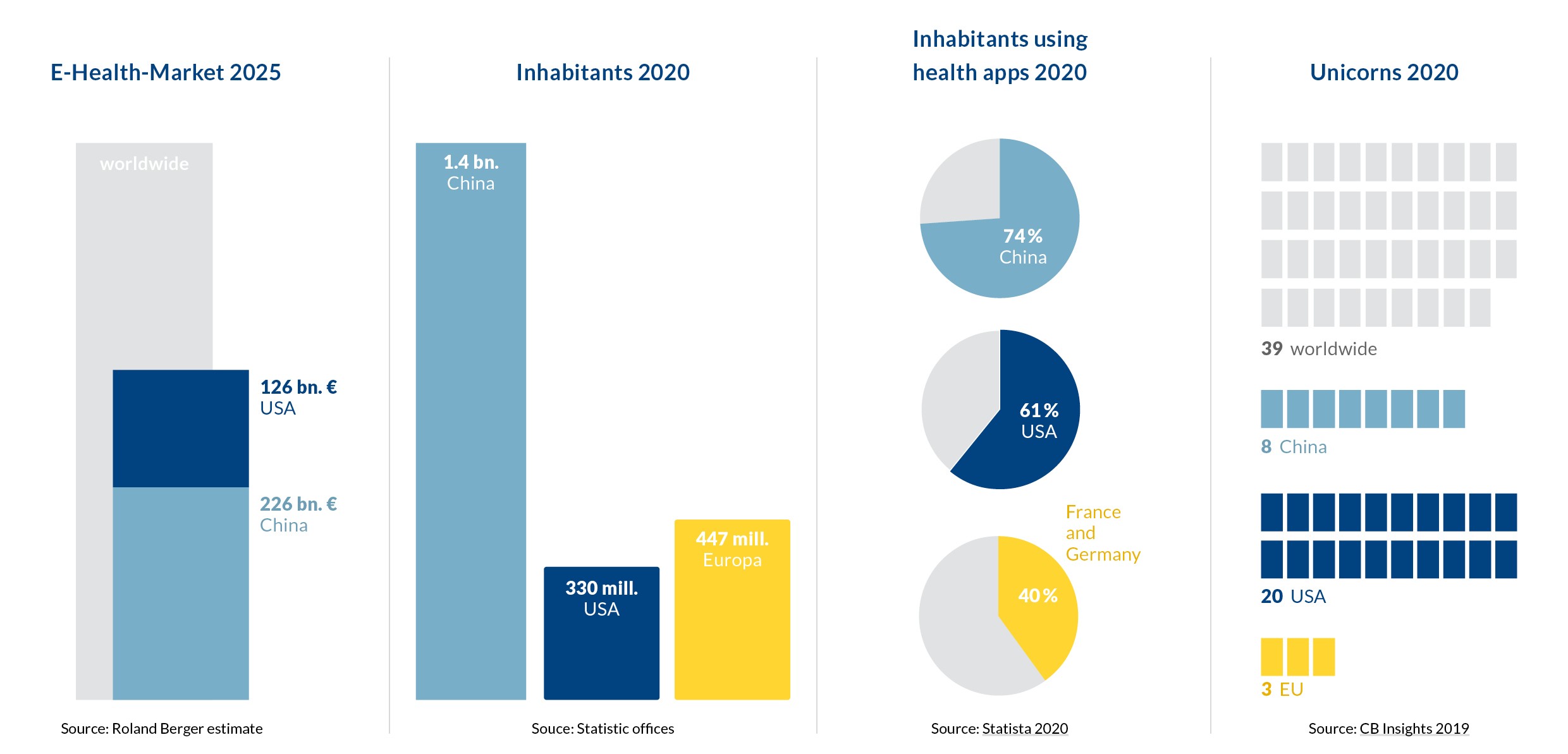

By 2025, China and the U.S. will account for nearly 60 percent of the global e-health market, with an estimated volume of €226 billion and €126 billion, respectively. The size and dynamics of the market are also reflected in the higher than average proportion of “unicorns”, i.e. young companies with a stock market valuation of more than one billion dollars. According to a market study, 20 of the 39 digital health unicorns worldwide in 2019 came from the United States; eight came from China, and three from the European Union.

Vision: EU as a single e-health market

The EU has the potential to become the second-largest single market for digital health – with an estimated volume of 155 billion euros and around 500 million users by 2025. Such a market would have a number of commercially competitive advantages:

- It would strengthen the international competitiveness compared to China and the USA.

- It would offer more opportunities for successful companies to develop, as they would be better placed to enter global markets on the basis of a large domestic market.

- EU-wide uniform apps that go through standardized authorization procedures would potentially benefit from greater public acceptance and trust.

- Innovations that must compete across the EU would succeed and result in stronger businesses than would be the case with small, country-by-country EU markets.

In addition, a single e-health market across the EU would be strengthened by a greater potential for investors. Startups have received just under four billion euros in venture capital from investors since 2018 – compared to four times that amount in the US. An EU-wide market would offer e-health solution developers much broader market access. It would also make it easier for them to raise investor capital and scale up. And products that succeed across the EU would also have a better chance on international markets. Other advantages: EU-wide start-up competitions could accelerate the development of innovative digital solutions, and pooling EU resources could facilitate more investment in innovative technologies, for example, to match China’s or the U.S.’s investments in the field of artificial intelligence as well.

The EU’s competitiveness in the global market for health data could also be boosted by a single e-health market. With its large integrated healthcare systems, China reaches at least 200 million customers, and technology giants in the U.S. are also acquiring large amounts of healthcare data by purchasing existing databases.

The EU’s competitiveness in the global market for health data could also be boosted by a single e-health market. With its large integrated healthcare systems, China reaches at least 200 million customers, and technology giants in the U.S. are also acquiring large amounts of healthcare data by purchasing existing databases.

Europe also has the opportunity to access large data pools for the development of innovative diagnostics and therapies. This could involve pooling data, for example, for individual areas such as disease-related registries, or with pseudonymized or anonymized data from patient records. This is because the prerequisites for Big Data evaluations are large base populations and data volumes, which the individual EU countries do not have.

However, in order to benefit from the many advantages of a common e-health market, uniform market access is necessary. Germany is setting a good example in this regard: the Digital Care Act enables regulated market access for digital healthcare solutions and their reimbursement by statutory health insurers. A similar approach would have to be adopted in the EU, for example, with EU countries recognizing each other’s authorization procedures. In such a way, an app that had passed through the approval process at the Federal Institute for Drugs and Medical Devices (BfArm) in Germany could also be marketed as a digital health application in other EU countries – with price negotiations continuing to take place at the national level.

Admittedly, this would require more complex structures on the provider side, for example in sales. But the benefit here would be obvious: A few successful companies could succeed – and reach a comparable size to their international competitors.

The Bertelsmann Stiftung’s impulse paper* contains a total of seven recommendations for action for an integrated European e-health strategy. We will discuss a number of them in more detail in a series of blog posts:

- An integrated European e-health strategy must be tailored to the needs of citizens.

- An integrated European e-health strategy must create a single e-health market.

- An integrated European e-health strategy must include the governance for a European health data space.

*Paper available in German with English recommendations for action.